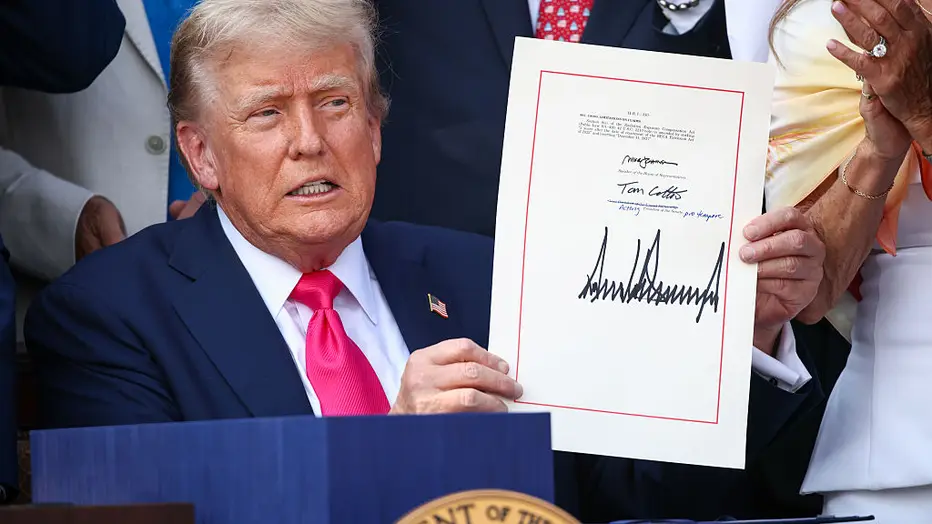

Trump Signing Means More Health Spending Improvements/Options

President Trump signed the bill last week after the Senate sent it to his desk. The bill includes provisions that benefit healthcare buyers and expands access to Health Savings Accounts (HSAs). Bronze plans become HSA eligible, HSA funds can be used for direct primary care arrangements, FSA limits increase and TeleMedicine Flexibility Improves.

Health Savings Accounts (HSAs). Bronze plans become HSA eligible

- Any Bronze or Catastrophic plan offered on a state insurance exchange under the Affordable Care Act (ACA) will be considered “HSA-qualified” coverage, effective January 1, 2026. This is significant as 7.3 million Americans are covered by these plans in 2025.

- Significant Shift in HSA Eligibility for ACA Plans: This bill makes a crucial change by classifying Bronze and Catastrophic plans on state insurance exchanges as “HSA-qualified.” This directly addresses a long-standing technicality that prevented many affordable ACA plans from being compatible with HSAs, despite their high-deductible nature.

- This is a massive expansion of HSA access for millions of Americans, potentially making these plans more attractive and empowering individuals to manage their healthcare costs with tax-advantaged savings.

HSA funds can be used for direct primary care arrangements

- HSA funds can be used tax-free to pay periodic fees for direct primary care (DPC) arrangements, effective January 1, 2026. These provisions apply to DPC arrangements with a monthly fee of $150 or less ($300 for more than one individual).

FSA limits increase

The bill increases the annual limit on contributions to dependent care Flexible Spending Accounts (FSAs) from $5,000 to $7,500, effective for tax years beginning after December 31, 2025. For those married filing separately, the limit increases from $2,500 to $3,750.

TeleMedicine Flexibility Improves

- The bill restores and makes permanent the safe harbor for pre-deductible telemedicine coverage, allowing HSA-qualified high deductible health plans (HDHPs) to offer this coverage. This change is retroactive to plan years beginning after December 31, 2024.

- Increased Flexibility in Plan Design and Telemedicine: Beyond just HSA access, the bill signals a move towards greater flexibility in health plan design. The permanent restoration of the safe harbor for pre-deductible telemedicine coverage is a prime example.

- This not only supports the continued adoption of telemedicine, which became vital during the pandemic, but also shows a willingness to loosen previous tight restrictions on HSA plan design. This could pave the way for even more innovative and consumer-friendly plan options in the future, allowing for coverage of services before the deductible is met.